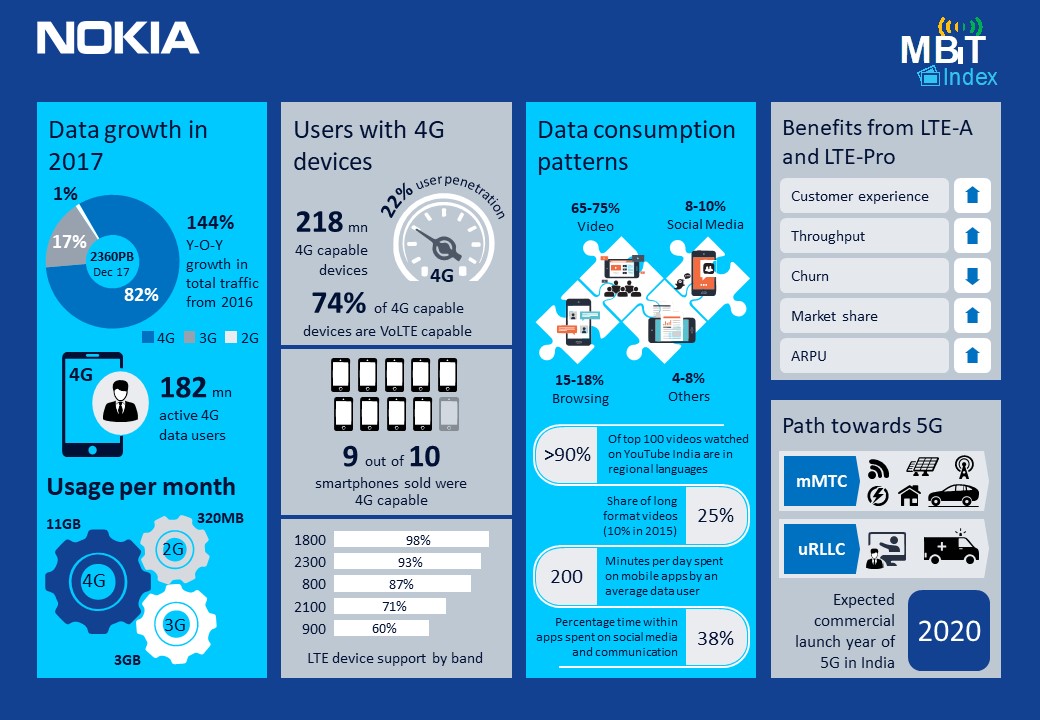

Nokia’s annual Mobile Broadband Index study of mobile broadband performance in India shows that 4G emerged as the key driver of mobile data consumption in 2017, capturing 82% of mobile data traffic and growing 135% YoY with the rapid deployment of 4G networks and affordable devices. 3G grew data grew 286% in 2017, driven by an increased appetite for data consumption and better coverage.

According to the report, data consumption continued to be driven by video, which contributed 65% to 75% of total mobile data traffic. This was powered by the availability of Hindi and regional language content, as well as the proliferation of original OTT-only series. In 2017, Hindi and regional languages comprised more than 90% of popular videos watched online.

On average, an Indian subscriber consumed 7.4 GB of data per user per month on their mobile devices over mobile networks alone, placing India ahead of developed markets like the UK, South Korea and France. The average consumption over both Wi-Fi and mobile networks in India was 8.8 GB data per user per month, at par with other developed markets.

Indian telcos continued to rapidly expand 4G in 2017 and have narrowed the gap with 3G coverage in the country. The 4G network expansion was supported by the dramatic growth of LTE devices in the country, with 9 out of 10 smartphones shipped in 2017 supporting 4G. The LTE-capable device base grew to 218 million in 2017, with 74% being VoLTE capable as well.

Service providers will need to take advantage of technologies such as 3-band carrier aggregation and 4×4 Multiple Input Multiple Output [MIMO] to transform their networks and sate the ever-increasing demand for data consumption without a glitch. The deployment of LTE-A/LTE-Pro and Cloud RAN will further enhance the customer experience.

Sanjay Malik, head of India Market, Nokia said

The year 2017 saw telcos expand 4G networks, and this momentum is likely to continue. The drop in prices of devices, both smartphones and feature phones, is driving data consumption in the country.

We believe that the next wave of growth in the Indian broadband market can come from the untapped base of feature phone users who will potentially move directly from 2G to 4G. As we mentioned in the last MBiT study, Indian telcos will need to explore innovative network technologies, like carrier aggregation and MIMO, to meet the growing data demand. These technologies will also help them prepare networks for the 5G and connected devices era.

Other key trends expected in 2018

- As the adoption of 4G increases beyond Metros and Tier-1 cities, 4G is expected to drive the bulk of data traffic in 2018.

- LTE-A / LTE-Pro and Cloud RAN could help Indian operators enhance the customer experience, reduce churn, increase market share and drive higher ARPU.

- 5G use cases like Massive Machine-type Communication [mMTC] can support the deployment of smart cities; ultra-reliable and low latency communication [uRLLC] can enable low latency healthcare and digital education.

- Driven by operators investing in virtualized networks as part of their 4G rollout, the commercial launch of 5G in India is expected by 2020 in line with other developed markets.

About the Nokia MBiT Index

Nokia MBit Index is a report on mobile broadband performance in India. The primary objective of the MBit Index is to provide reliable time-series based statistics and insights about mobile broadband traffic growth in India, and co-relate those trends with changes in various ecosystem drivers such as subscriber usage patterns, devices, tariffs, coverage etc. The MBit Index analyses mobile broadband traffic trends only at a consolidated level.