MoneyTap, India’s first App-Based Credit Line has now crossed the milestone of 1 million user installs. With an aim to serve the lower-middle income group, MoneyTap has now lowered the annual interest rate to 13% [down from 15%].

The company also tripled its growth in the last three months owing to the festive season and is seeing continued momentum in the current wedding season. MoneyTap is also now available to people in Indore, Vijayawada and Vishakhapatnam. With the addition of these three cities, India’s first credit line is now available in 20 cities in India.

The majority of MoneyTap users have a monthly income of INR 35,000 and are aged between 29~31 years, with the average Credit Line issue size being INR 85,000. Consumers tend to do multiple withdrawals from the Credit Line over a course of time and very few of them tend to withdraw the entire line amount. In-fact, 65% of the users have not used the entire amount at one shot but have used it multiple times over multiple months.

This usage pattern indicates that consumers frequently need small amounts of credit to tide over essential purchases and payments. Consumers also have varied requirements when it comes to cash and card. Not all purchases can be done through cash and not all payments are accepted by card; MoneyTap is currently the only product in the market which offers its consumers the convenience of using both card and cash through the App. Around 60% of transactions on MoneyTap are cash withdrawals and 40% are from card payments.

During 2017, MoneyTap pioneered the concept of a Credit Line for consumers. An unknown concept until now, Credit Line has seen a huge demand from consumers in the lower-middle income group, due to its unique product which combines the usage of cash and card. Consumers are not comfortable going to banks for loans for minimal amounts which could be anywhere from INR 3000 to INR 50,000 or even up to 1 or 2 Lakhs. The needs of consumers vary and could be anything from medical, birth, death, school fees, deposit to take a rent on house, etc. and asking for money from family and friends always has an embarrassment factor. The Credit Line for consumers with accessibility through an app is literally like a friend who gives you money when in need, be it marriage, birth sudden death in family, school fees, hospital bills or sudden cash crunch during the month end.

Every time customers decide to withdraw a certain amount from their pre-approved Credit Line, MoneyTap allows them to choose their own EMIs, which ranges anywhere between 2 to 36 months. It is not pre-fixed and is up to the repaying capacity of the borrower.

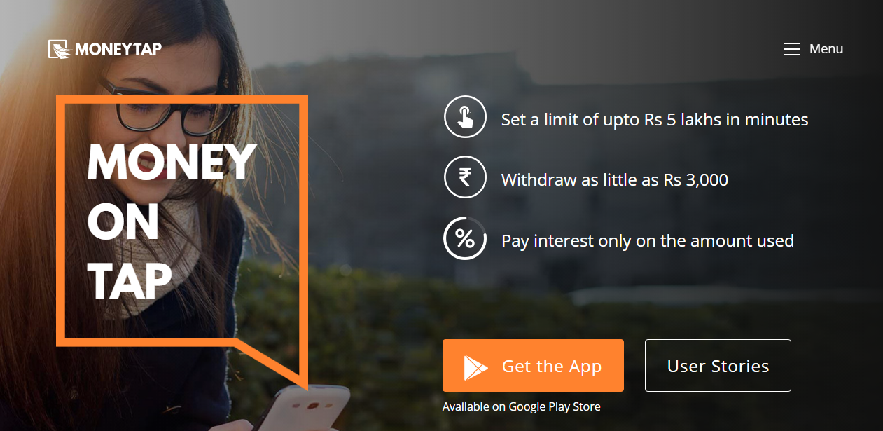

MoneyTap is available on Android Playstore and is targeted at salaried individuals and self-employed professionals earning more than INR 20,000 per month. Using the Credit Line, consumers can choose to borrow as little as INR 3000 or as much as INR 5 lakhs or up to their maximum eligibility limit. Customers can decide their own EMI plans with flexible payback periods ranging from 2 months to 3 years.

Interest is paid only on the amount borrowed and rates can be as low as 1.08% per month. If the user does not borrow any amount, then no interest needs to be paid. The credit limit also gets replenished once EMIs are paid back. All financial transactions such as billing and repayment are directly dealt with the respective bank or NBFC through the MoneyTap App using secure APIs, thus ensuring 100% secure transactions.

To keep up with its rapid expansion plans, MoneyTap is increasing its employee count and plans to add 50 new team members in Tech, Data, Product, Marketing & Ops in the next 6 months. MoneyTap also plans to solidify its leadership position by improving credit accessibility for other segments of customers, partnering with 6 other Banks and NBFCs and expanding to 50 cities in India by March 2018. The Bengaluru-based startup recently raised a total of $12.3 million in funding from Sequoia India, NEA & Prime Venture Partners.

Anuj Kacker, Co-founder, MoneyTap, said

We are excited about the possibilities that MoneyTap can bring to thousands of millions of Indians who are facing a cash crunch for regular needs. We help consumers get credit easily and quickly with the power of mobile technology. Middle income customers [salaried & self-employed] making Rs. 20,000 per month or more are not serviced by financial institutions today without putting up collateral such as gold or those who need smaller amounts.

This is the clear unaddressed need. When we spoke to customers, they not only wanted the above needs addressed but also wanted the product to be very flexible and convenient. For the very first time, MoneyTap is bringing the access to credit with a single tap on the mobile phone.

About MoneyTap

MoneyTap is a Bengaluru-based