Jeet Suri does not own a credit card. He does, however own an apartment in Bangalore. It is almost bare, save for his furnished bedroom and modular kitchen. Considering the hefty furniture costs, he knows that he will need to avail of a personal loan to get his apartment fully furnished. But this is easier said than done! As a 24-year-old IT professional in a medium-sized IT firm, he has been denied personal loans twice in the past for not having the requisite Credit [or CIBIL] Score.

Jeet has now made the decision to apply for a loan from one of the new Fintech startups that specialize in giving quick personal loans to salaried people. He applies, gets his approval within 2 hours and funds reach his account in 48 hours! Jeet himself is surprised at the smooth and quick process. And this is exactly what attracted numerous alternative lenders in the country to start online lending platforms, albeit at somewhat higher interest rates.

The Indian Banking Sector has quite a history of bad loans and non-performing properties that has made lenders [particularly public sector ones] more cautious and conventional. There are more than 1.5 million companies in the country, but banks tend to focus on lending to only to those salaried applicants working for less than 50,000 companies which are listed in their target databases. So where do the rest go for loans? This explains the rise of close to 100 alternate lenders in India in the last two years alone [India has the 3rd largest number of personal lending startups in the world, after China and the USA!].

This new breed of lenders can be broadly categorized as follows

Aggregators or Lead-Generators

Aggregators are solely responsible for generating a lead and passing it on to one, or more, banks. This is a commission-based task and they earn a fee per lead, regardless of whether the loan is approved [and eventually funded] or not. The decision to lend lies with the bank or the non-bank lender, who makes the final credit decision on the case. BankBazaar and PaisaBazaar are two notable names in this niche.

Direct Selling Agents [or DSAs]

DSAs do everything the aggregators do and some more. Aside from lead generation, they take care of the entire documentation process too, hereby assisting you in ensuring that your loan is approved. Here, too, the credit decision lies with the ultimate lender [a bank or a non-bank lender]. DSAs charge a fee to the lender, which typically ranges from ranging from 1.5 to 3 percent of the loan amount. Finance Buddha and Finwizz are two notable names.

Consumer Durable Financing Marketplaces

Increased income, soaring consumer aspirations and easy cash access have prompted a sturdy growth in big-ticket purchases like electronics goods and furniture. Of the numerous schemes that have developed to fund these acquisitions, zero-interest EMIs and cardless EMIs are the most common. Astonishingly, in India, more than half of such purchases are made possible using small ticket loans from non-bank lenders! Here too, the lenders make the ultimate decision on the customer, and the platforms typically earn a commission or some sort of revenue share.

Business Correspondents

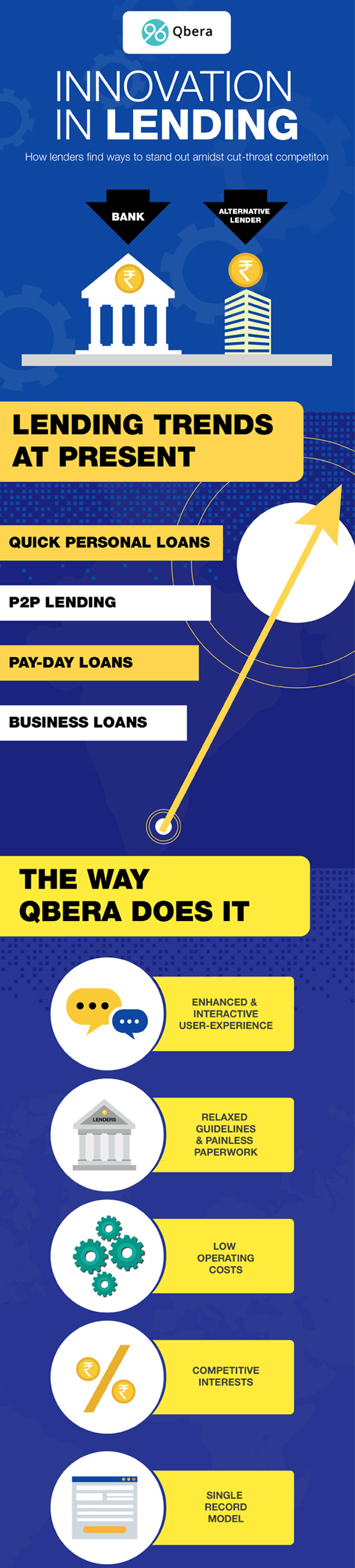

Business Correspondents take ownership of the entire life-cycle of the loan, from acquiring the customer, underwriting the loan, documentation, verification and ensuring the final loan is disbursed. The loans are funded by one of more lending partners and, uniquely, the platform plays a role in making the credit decision. They are not middleman, as they usually share risk [as well as revenues] with the bank or non-bank lending partner. Qbera is one such startup that is operating on this model

Summing it up

The online lending landscape in India is evolving rapidly. New-age online lenders are giving the incumbents a run for their money, as they partner with a variety of capital providers to test segments which have previously been untapped. Added to this, they provide a superior customer experience, which includes more transparency, a better approval rate, a convenient process and lower turn-around times. However, time will tell how many of these new-age lenders will be able to target new, profitable segments, whilst scaling their businesses with low(er)-cost capital, and do all this while maintaining the quality of their portfolio.

About the author

Nidaa Chakkittammal is a Proud feminist, former journalist, certified mountaineer and currently Content Manager at Qbera. She believes self-discovery is an eternal journey. When she isn’t drafting finance articles and blogs by the dozen for Qbera & other similar platforms, she is busy reading romantic poetry and fiction, rollerskating, participating in marathons, cycling, chilling with friends and trekking. You can find more about her on her LinkedIn profile page.