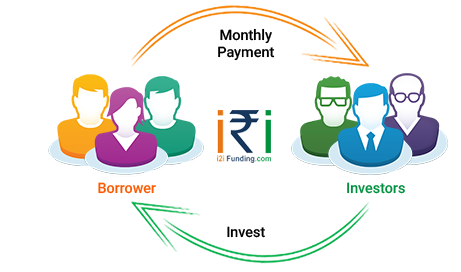

The year 2016 has so far been an eventful for Fintech startups in India and initiatives like Digital India, Aadhar, UPI etc. are opening up new opportunities for entrepreneurs. There is one sector P2P (Peer to Peer) lending which is a financial innovation that connects verified borrowers seeking unsecured personal loans with investors looking to earn higher returns on their investments.

Though P2P is popular financing option across the globe, it is still at a nascent (or growth stage) in India. However, it is gradually becoming an attractive option for investors who are looking for better returns via short term loans.

Today we talk to Raghavendra Pratap Singh, Co-founder of P2P Lending website i2ifunding.com. The extensive discussion revolves around i2ifunding, P2P market landscape, UPI, financial inclusion, entrepreneurship, tips for fintech entrepreneurs etc. So, lets start with the Q&A…

Can you tell us more about the origins of the company?

We started working on this idea in late 2014. One year later after spending numerous number of hours in discussion, planning, development and operational set up, we launched i2ifunding.com in Oct 2015. Since then, we have never looked back. We have a diverse, intelligent and committed team which works in unison to achieve the dream of making i2ifunding a leader in Peer to Peer lending space in India.

We have 5 co-founders from diverse background who take care of different responsibilities.

Vaibhav Kumar Pandey: Vaibhav has 10+ years of experience in setting up large scale operations from scratch, driving operational efficiencies, and building and leading large teams. He has successfully designed and led the development of various enterprise level solutions. Vaibhav completed his MBA from IIM Ahmedabad in 2009 and his graduation from T.S. Chankya in nautical science in 2002.

Raghavendra Pratap Singh: An IIM-Calcutta alumnus and ex-merchant mariner, Raghavendra has more than 10 years of global experience in Product development, e-commerce, operations, digital marketing and client servicing. At i2i, Raghavendra is part of founding team and responsible for Product development and Marketing. He is also actively involved in formulation and execution of growth strategy of i2i. He has worked in British Petroleum, Genpact and Aptara previously. He is a sport enthusiasts and follows politics passionately.

Neha Aggarwal: Neha in her short span of career has worked from brand management in FMCG sector to product development in financial sector. She has handled SHG & FDOD instruments in past of over $25 million. With her ever resilient attitude, she has launched multiple successful products in the Indian market. Neha completed her MBA from XIM-Bhubaneswar and graduated from Delhi University with distinction in Finance.

Abhinav Johary: Abhinav has more than 7 years of strong experience in business operations and setting up new processes. Prior to i2i, Abhinav was engaged with Flipkart and worked on several strategic initiatives in it’s market place operations. At i2i, Abhinav is part of founding team and responsible for managing loan origination and operations. He was instrumental in setting up the processes. This engineer cum MBA is a go-getter to whom you can assign any task and rest assured that it will be done.

Manisha Bansal: Manisha is a Chartered Accountant and brings with her over 8 years of domestic and overseas work experience in various fields. She has also worked in the past with NGOs like CAT Protection and ADHD in UK overseeing finance and treasury activities. She has also worked with Birla Sunlife Insurance in the past. Manisha looks after investor interaction, strategy formulation, strategic tie-ups and regulatory relationship management besides day to day business involvement and overseeing Mumbai office activities.

i2iFunding is all set to change the way in which financial transactions are being currently carried out in India. Traditional financial systems due to their high operating costs such as high office rentals, high employee costs etc. are unable to diligently assess each of the customers as per their risk profiles. Therefore, they consider the retail loans (i.e. loans offered to individual persons) as ‘flow’ business which results in customers with varying credit quality getting bucketed together. This is not only unfair to borrowers with high credit quality but also leads to inefficient utilization of financial resources.

How much funding was needed? How much was raised at what valuation?

Initially, we were boot strapped and launched the portal in Oct 2015. We received funding of $300k in May 2016 at the valuation of $ 4 million. We are looking at next round of funding in the range of $3-4 million to ensure, we are complaint with regulations from RBI (Central Bank) which is expected in next few months and maintain the growth rate.

What is your product? Business model? Pricing?

i2ifunding is an online platform, we connects verified borrowers looking for unsecured personal loans and investors looking for alternative investment opportunities for higher returns. i2iFunding does detailed Credit Risk evaluation each borrowers and only qualified borrowers are made live on portal along with recommended interest rate and risk category.

Once the funding is complete on the website, we conduct physical verification facilitates legal documentation between borrowers and Investors.

We understand the importance of timely repayments, and hence, endeavors to keep full track of the loan repayment schedule and report any delay or default at the earliest. We also suggest a corrective action plan and assist in loan recovery and collection etc. if required. Our aim is to ensure seamless investing and borrowing experience.

Registration Fees – Borrowers – (INR)Rs. 100 and Investors (INR)Rs. 500

Processing Fee from Borrowers: Depending upon the risk category – A to F ( 3% to 6% of loan amount disbursed)

Fund Management fees: 1% of investment amount from Investors

How does it differentiate from other existing P2P players in the market?

i2ifunding.com is much more than P2P marketplace. Apart from providing end to end loan servicing, i2i diligently evaluates the credit risk of each of the loan projects, post which it assigns risk category and recommends an interest rate for that project (a borrower can borrow at an interest rate which is higher than or equal to this rate).

This helps the borrowers as well as the investors to have a benchmark interest rate. In the process, the investors get an opportunity to earn higher ‘risk adjusted returns’ while the borrowers get an opportunity to get funded at the lowest cost possible as per their risk profile and market based demand. We also provide legal and recovery support to investors in case of default by any borrower along with Principal Protection to ensure downside is limited for investors in case of default.

How has the P2P industry changed or you foresee any changes after UPI was introduced?

UPI introduction has not made any impact on P2P industry. UPI can reduce the transaction effort between borrowers and lenders but again P2P platform will have to be dependent upon borrowers and lenders for confirmation of payment and larger issue of automation will not get solved.

There is a general question with lenders, what happens if borrower is not able to return the money. How is the lingering question of Credit Risk taken care of ?

On our platform, very detailed Credit Risk evaluation of borrowers are done and almost 90% applications get rejected at this stage. So only good credit worthy profiles are available on our portal.

All the loans are backed by legal agreement and promissory notes along with undated cheques. In case of default, legal action is initiated against the borrowers. Both Civil as well as criminal suite can be filed against the defaulter.

On top of it, we also have Principal Protection in place, which protects part of principal against default depending upon the risk category of borrower.

Can you share with us the main key performance numbers of your company? How did they change over time?

i2ifunding started operation in October 2015. Within 11 months we have more than 3500 registrations. We have already closed the funding of around 150 loans and have more than 500 investors with an investment commitment of over INR 50 million.

Before angel round, we were doing around INR 0.5 – 1 million/ month and now we are doing INR 3-5 million of loans/month with MoM growth of 20-25%.

What is your competition like? What is your edge on the competition?

P2P lending is a very new concept in India. Although it is a very successful model in countries like China, US and UK. All the players in India are startups (around 10), most of them began operations in the last 1-2 years and are still trying to find their feet in this segment. We are mainly competing with Faircent, Lendbox and i-lend.

We have very strong focus on credit quality of loans. We have our own Propriety Credit score model which evaluates borrowers on more than 40 parameters. We also have mandatory physical verification in place before disbursal of funds.

Our focus is to keep delays and defaults to the minimum by continuously improving our proprietary credit risk evaluation model with the use of technology. In longer run, platform with credible repayment track record will move ahead of others.

We also offer Principal Protection to investors in case of defaults by Borrowers. Offering principal protection further shows our confidence in our underwriting process. No other platform in India, except i2iFunding is offering principal protection plan to investors.

Can you explain in detail how the entire process of selecting right investor works (in case there are multiple investors that match the borrower’s requirement) ?

All the live loans are listed on portal along with risk category and interest rate and other important details about the borrowers. Investors can see and show investment interest in that profile as soon as they do that available amount in that loan will reduce by that much amount. So for other investors only available amount will be left for investment. We restrict one investor to invest only up to 20% in a particular loan so that his investments are diversified.

According to your data, which is the biggest category (buying house, repairs, wedding etc.) where borrowers require money ?

For Salaried: Personal Debt Consolidation (Credit Card repayment) and House Renovation

For Self-employed people: Business expansion

Please give some insights into the implications of Money lending (on P2P sites like i2iFunding) on income tax returns (for borrower as well as lender)

For investors, this income will be treated as interest income and it needs to be added into income for tax purpose. Borrowers will not get any benefit on interest paid as with other personal loans.

What is the TAM of the consumer debt market that i2iFunding is trying to address

Informal lending market which already exist in India is of Rs. 1 Lakh crore in Urban India which is 15% of total debt market in personal loan sector. MSME lending sector is much bigger and we are trying to tap that market as well.

Apart from CIBIL score, Social score; are there other data points that i2iFunding has to evaluate members (lenders/borrowers) ?

We evaluate each borrower on more than 50+ parameters through our proprietary Credit scoring model. Some parameters are like-Type of Company, Employment stability, Employability of person, Education back ground, type of education and marks, Type of accommodation, Stay duration at current location, Debt to Income ratio after loan and many more.

Who are your typical customers? Why do they works with you?

Borrowers Profiles: People who are not getting personal loans easily from existing financial institutions. Banks/NBFCs do not give loans to people who do not have credit history or people whose credit report got bad due to some unavoidable reasons. Also, these institutions do not give loans below certain salary level and in certain geographies.

Borrowers can submit loan requirement in a few simple steps without unnecessary paperwork or a trip to the bank from the comfort of their own home. They can monitor the progress of loan online and once the funding is complete, money is transferred by the investors in to their account directly.

Investors Profile: People with annual income of more than INR 1 million and who are looking to earn high returns and have some appetite for risk. i2i provides excellent opportunity to earn higher returns in comparison to mutual funds and equities with much lower risk.

i2iFunding is an alternate mode of investment and financing, which is much faster and efficient than prevalent legacy systems. It provides seamless user experience in terms of ease of transaction, ability to view and download detailed account statements, transaction analysis and many more features. Investors can lend to a borrower in a few simple steps.

Few years back, there was huge wave about MFI’s (like SKS Microfinance), in 2016 the wave is around fintech sector (NBFC’s), what are your thoughts about the future of Fintech ?

Fintech space is definitely going grow especially in country like India where traditional financial institutions have failed to cater demands. There is still huge population in India which does not have access to credit at the same time people do not have many investment options. There are already too many innovations happening in this space and it is evident from the growth of Fintech companies in India.

There is huge potential for P2P in O2O space, are there any plans to address those set of customers (who are credible) but do not use the online medium for attaining short-term loans?

Yes, we agree there is huge market potential in O2O space for P2P and in some ways we have already started that. We are using our channel partners to reach out to them. They create their profiles online and then we verify all the details before approval of loans. In last month, we approved many borrowers from MCD who did not know how to operate computers.

Are there are any specific laws regulating the P2P businesses in India or to put it the other way round, is there a requirement to regulate P2P lending in India?

RBI has taken cognizance of this sector and they have already come up with a consultation paper for regulating this sector. We are expecting regulations from RBI in coming months.

There is a need of regulation from RBI as it will give credibility to this sector and deter non serious players. Also, it will bring more discipline and transparency.

Does i2iFunding have plans to serve BOP segment (similar to what MFI’s do)?

As of now, we do not have any plans to cater to this sector but we will surely reach out to this market once we are established.

Does i2iFunding have any e-commerce partners where customer on that platform can get short term loan from lenders on i2iFunding (instead of opting for EMI or other payment mechanism)?

We are under discussion with many players but as of now nothing has been finalized yet. One key challenge is that investors are looking for higher returns on P2P platforms and many e-commerce players are looking for loans to their customers at low interest rate. But it would not be too late before we crack this model.

What do you think about the direction of the industry?

While P2P lending is still at a nascent stage in India, it is one of the leading means of financing in countries such as the US, the UK, Germany, China etc. and many p2p players have grown to become Billion dollar companies. It has been growing in leaps and bounds around the world, thanks to an increase in the internet penetration and tremendous acceptability of e-payments.

In India also, we see P2P lending to follow the similar growth trend that has been witnessed by ecommerce industry. We currently have investors from all across the country; however, borrowers are mainly from 4 metros. We are looking to expand to all major cities of India in next couple of years. We are investing very heavily in technology, and will be a technology driven platform which will help investors and borrowers transact very easily.

Reserve Bank of India (RBI) has also taken cognizance of this phenomenon in India and has already come up with a consultation paper. Very soon RBI is going to come up with regulations to govern this sector and make it a credible alternative financing option.

Can you please talk about the particularities of the India market? Interest rates for savings? Ease to get loan?

In India, almost 75% population does not have easy access to credit. Penetration of Established financial institutions in India is very low. At the time of need, many people take loans from friends, family and relatives. There is also a huge offline market of taking loans from private money lenders who charge very high interest rates.

Established financial institutions have very strict and legacy underwriting models based on traditional mode of lending and loans are rejected for reasons like low or no credit history, working in a particular industry, stays in a particular geography or has existing loans. Banks do not have resources and time to analyse each loan application purely on the basis of its merits and so they have decided some broad parameters which filters large population even though most of them are credit worthy.

It is even more difficult for self-employed businessmen or professionals as banks do not give them unsecured loans.

Also, overall time taken in processing the loan application and documentation process is overwhelming and cumbersome. People looking for small business loans are finding P2P as very good option to take loans and slowly it is becoming major portion of P2P loans. Though it is difficult to underwrite the business loans but it provides huge opportunity to P2P players. I2i has also developed its own model to assess the risk of business loans and has started offering loans to MSME sector as this is place where the growth is.

Investors in India have very few investment options. Bank fixed deposits and secured investments options can give you returns only up to 8-9%/ annum. A country like India where inflation varies from 3-8%, these returns are not attractive. They have also lost trust in Mutual funds and Equity market. Real estate sector and gold has also lost it’s charm as average returns from these investment options are not attractive and vary drastically. P2P sector is providing them a very good alternative investment option where they can earn returns in the range of 20-25% per annum. Though they are still sceptic about this concept but slowly P2P is gaining traction and many early innovators have started shifting their investments from Mutual funds and equities to P2P sector.

India has right ingredients in place for P2P industry where there is huge population which is denied of credit and a very big middle class which wants to earn higher returns on their investments.

In past 2 years, we have seen around 10-15 start ups in P2P sector, however only few of them are serious players and are here for long term. In India, there are some P2P sites that cater to individual loans, pay day loans, while others do a mix or individual and business loans. There is also social P2P lending companies who provide loans to underprivileged section and interest rates are nominal.

Are there are any the RBI norms around the P2P lending market?

The Reserve Bank of India, recently came up with a consultation paper to regulate the sector. P2P lending has great potential, especially in a country like India, where huge parts of its population do not have any access to institutional sources of finance. The Central Bank rightly feels it is very important to ensure the sector plays a constructive role in bridging the divide.

“P2P lending promotes alternative forms of finance, where formal finance is unable to reach and also has the potential to soften the lending rates as a result of lower operational costs and enhanced competition with the traditional lending channels. Therefore, the importance of these methods of financing needs to be acknowledged. If properly regulated, the P2P lending platforms can do this more effectively,” says the RBI consultation paper.

It goes on to add that regulations at this stage would also prevent any unwanted surprises, something that became evident in the Chinese market. India is the only country with a billion mobile phones and biometrics. There are about 350 million using the Internet today, but by 2020-23 there will be about 1 billion people in India using the Internet. As products and services move online and the country becomes increasingly connected, the role of online lending is expected to grow manifold.

“If the sector is left unregulated altogether, there is the risk of unhealthy practices being adopted by one or more players, which may have deleterious consequences,” says the RBI.

Your thoughts on Digital India campaign and how it has created opportunities for startups/companies catering to those areas?

Digital India campaign has surely brought more focus to this sector and as internet penetration increase all online/internet based startups/companies will get benefited. Combined spend being planned by corporate and government is in excess of Rs 4 lakh crores.

This huge investment will create lot of opportunity for start-ups where they can add value. Nothing measurable can be seen as of now but very soon we start seeing benefit of digital India campaign.

Can you share some hiring tips for entrepreneurs (especially when they are building the core team)?

Know your business and key skill set without which your business will not survive. Your core team should have people who can run the company without being dependent upon any one. And skill set should be complementary to each other so that effort spent by everyone gives better results.

Bootstrapping vis-a-vis Institutional Funding, your views on the same?

Both have their own pros and cons. While Bootstrapping forces you to become more innovative and spend money only in those areas where real value will be added to product and customers get benefited. But at the same time, there is lot of pressure on you which may affect your decisions adversely. Also, you cannot experiment much as you have limited funds.

Institutional funding gives you comfort and your main focus becomes making product and services better rather than looking at ways to save money. Also, you can do some experiments and pilots and then decide best possible action to expand the business. With money in your hand you can really expand fast if your idea is creating value for customers. Institutional funding also brings lot of unreal expectations and pressure to beat competitors. Sometimes you also get carried away with your plans and spend unnecessarily on things which are not adding value.

There are many startups in P2P Lending, what are some of the growth marketing techniques used by i2iFunding?

As of now we are only web based portal and very soon we are going to launch our app. We are creating app, as we have received request from lot of customers especially investors that it would be much easier for them to do small investment transactions on app rather than website.

For an online startup, digital marketing is very important and appearing in top 3 for all important keywords is a must. It saves lot of money in advertisement if you can get organic ranking in Google searches. Never neglect SEO, many companies especially start-ups suffer because they do not have skill set for SEO and in spite of having great product they are not able to reach out to potential customers.

Apart from Fintech, what are the next wave of startups that would excite entrepreneurs interest, VC interest?

I think something in Education, Medical or Energy sector. There are some start-ups but still there is huge potential as demand in this sector will never get over and it is increasing day by day.

Many startups/growth stage companies are now looking at unit-economics, how important is it to look at that factor early on in the startup’s journey?

Unit economics is important parameter but it should not be most important one. Most important parameter is value being created for customers and how customers should be dependent upon your product in that sector.

If Google or Facebook had started looking at unit economic in the beginning they would have never reached to this stage. But at the same time, you should know that you will be able to make money by leveraging the customers being acquired by you. Acquiring customers by giving them freebies is not a good strategy as they will shift as soon as you start charging them.

Closing thoughts to aspiring entrepreneurs.

Have faith in your idea and don’t lose patience. One of the most important factor to get success is Perseverance. Success will never come over night and be ready for long haul.

We thank Mr. Raghavendra Pratap Singh for his time and sharing his insights into P2P Lending, Fintech, etc. with such minute detail. We hope that our readers, specifically fin-tech entrepreneurs would have definitely taken few tips from this exhaustive discussion!

If you have any further questions for i2ifunding team, please leave them in the comments section or shoot a mail to himanshu.sheth@gmail.com and we would get it answered for you..