Life Insurance can be looked at in two ways- for the customer, it could be another Investment that can be covered as a part of 80C but for their family members, it means a lot more….it means Assurance. Assurance that if something untoward occurs then your family does not have to bear the brunt.

We insure our cars, house, bike and even mobile phones these days. In today’s fast paced world, life has become uncertain. One insurance policy that comes in handy in such circumstances is the ‘Term Plan’. A Term Plan is a basic life insurance plan that reimburses sufficient amount of sum assured to the beneficiaries of the insured after his/her demise.

However, during the planning process, there are many doubts that linger in customer’s minds about any Insurance Policy namely Premium Payment Cycle, Sum Assured, Hidden Clauses and Dependents covered as a part of the Insurance Policy etc. So, it is very critical to choose the best Term Plan or Term Life Insurance Policy.

Unlike other insurance policies that have attached investment benefits to it, Term Plan is a pure life cover plan. There are many financial institutions that offer Term Plans but one which scores above all the competitors is the Online Term Plan offered by Max Life Insurance. Let’s delve into more details:

Note : Views expressed in the review are based on interaction with existing customers of Term Plan by Max Life Insurance

Low Premium Payment, various Policy options

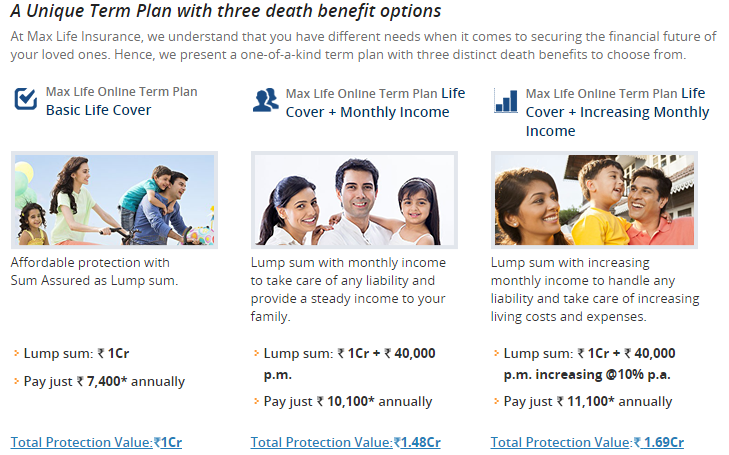

The main advantage of taking a Term Insurance is that you have the flexibility of choosing a plan with low premium and flexible payment options. Max Life Insurance has a unique term plan with three death benefit options:

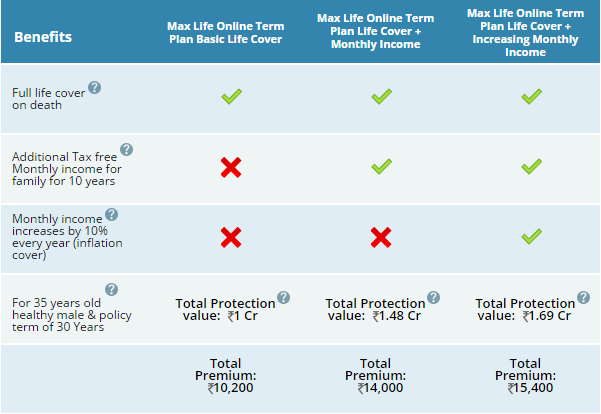

Max Life Online Term Plan Basic Life Cover – This is the basic and most affordable plan. The annual premium amount is Rs. 7400 and the sum assured is Rs 1 crore.

Max Life Online Term Plan Life Cover + Monthly Income – As the name suggests, this insurance cover comes with monthly income. It also ensures that your family does not struggle to make ends meet. The annual premium amount is Rs. 10,100 and the sum assured is Rs 1 crore (+ 40,000 per month).

Max Life Online Term Plan Life Cover + Increasing Monthly Income – This is the most ideal term plan. It ensures that with rising inflation, your beneficiaries’ income also increases to cope up with increasing costs. This policy comes with increasing monthly income. The annual premium amount is Rs. 11,100 and the sum assured is Rs 1 crore (+ 40,000 per month increasing at 10% p.a).

In case of death of the policy holder during the term, the nominee gets the sum assured. It is always advisable to choose the correct mix of Term Plan based on your age, income, dependents, health condition etc.

Double Security

As mentioned earlier, all the three plans mentioned above ensure that your dependents do not have to suffer after the demise of breadwinner. However, Max Life Online Term Plan Basic Life Cover & Max Life Online Term Plan Life Cover with Increasing Monthly Income are the preferred options by customers since they provide additional security to your family.

Choosing the RIGHT Term Plan

Depending on the factors mentioned above it is always advisable to consult your financial advisor before zeroing in on a Term Plan. If there is still that lingering question – How much cover do I need, than you have the option to choose the right plan by logging on to Term Plan Calculator. Selection of the wrong Term Plan will not only hamper your savings but would also have a lasting effect on your dependents! Ensure you make the wisest decision of your life and choose the best Term Insurance Plan

If you are an existing customer of Max Life Insurance [Term Plan] #MaxLifeTermPlan, please leave your experience or feedback in the comments section…

Disclaimer : Information provided in the article is based on my research and interaction with existing customers. Insurance is a subject matter of solicitation, please read the offer document before investing.